FinFloh: Accounts receivable software for CFOs & B2B finance teams

In the rapidly evolving financial landscape, CFOs and B2B finance teams are continuously seeking innovative solutions to enhance their efficiency and strategic decision-making. FinFloh emerges as a cutting-edge accounts receivable software that leverages artificial intelligence to transform the way finance professionals manage cash flow, collections, and invoice processes. This article delves into the capabilities of FinFloh and how it empowers CFOs and finance teams to optimize their financial operations.

Key Takeaways

- FinFloh leverages AI to streamline the accounts receivable process, enhancing efficiency and accuracy for CFOs and B2B finance teams.

- The software provides tools for advanced cash flow forecasting and automated invoice management, simplifying financial operations.

- FinFloh integrates seamlessly with existing finance stacks, offering automated follow-ups and data-driven insights for strategic decision-making.

Unlocking Financial Efficiency with FinFloh

Streamlining Collections with AI

Gone are the days of manual follow-ups and spreadsheet headaches. FinFloh is revolutionizing the way CFOs and B2B finance teams handle accounts receivable by harnessing the power of AI. With intelligent algorithms, FinFloh automates the tedious task of chasing down payments, ensuring that your cash flow remains healthy and predictable.

By leveraging AI, FinFloh not only speeds up the collection process but also provides insights into payment patterns, helping you to anticipate and address potential delays before they impact your bottom line.

Here’s how FinFloh makes a difference:

- Automated reminders that gently nudge clients just at the right time.

- Predictive analytics to forecast payment dates and manage cash flow effectively.

- Customizable communication templates that maintain your brand’s voice while being efficient.

With FinFloh, your finance team can focus on strategic tasks rather than getting bogged down by receivables management. It’s about working smarter, not harder, and letting AI do the heavy lifting.

Forecasting Cash Flow Like a Pro

Getting a grip on your company’s financial future is a breeze with FinFloh’s cash flow forecasting tools. Predicting your cash flow has never been more accurate or less stressful. With a few clicks, you can visualize your financial trajectory and make informed decisions that keep your business on the path to success.

FinFloh’s forecasting isn’t just about numbers; it’s about giving you the peace of mind that comes from knowing you’re prepared for whatever lies ahead.

Here’s how FinFloh turns you into a forecasting wizard:

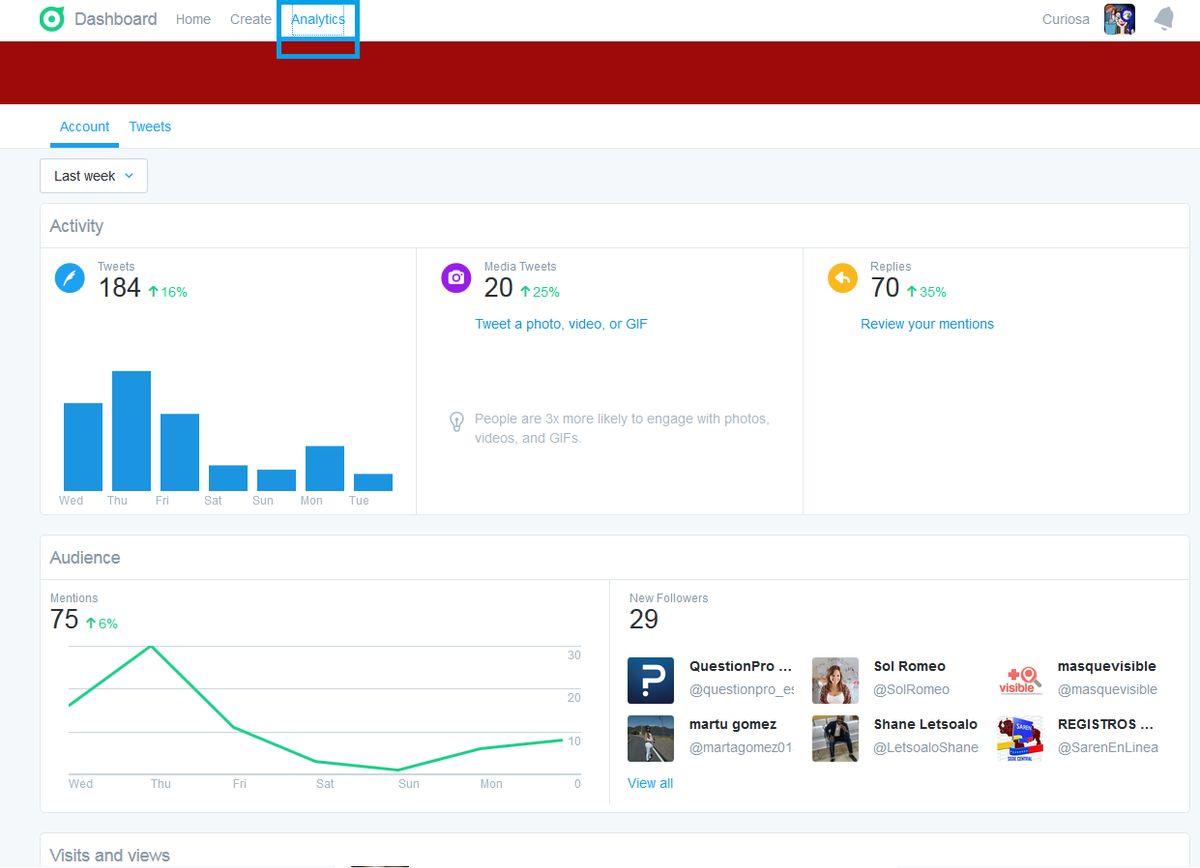

- Intuitive Dashboards: Get a clear view of your cash flow with user-friendly graphics and real-time data.

- Scenario Planning: Play out ‘what-if’ scenarios to understand potential impacts on your cash flow.

- Predictive Analytics: Leverage AI to anticipate future trends based on past financial data.

With FinFloh, you’re not just tracking numbers; you’re crafting a financial strategy that’s proactive, not reactive. And that’s a game-changer for any finance team.

Invoice Management Made Easy

Gone are the days of manual invoice tracking and endless spreadsheets. With FinFloh, you’re not just managing invoices; you’re mastering them. Imagine a world where every invoice is accounted for, organized, and processed with the click of a button. That’s the reality FinFloh brings to the table.

FinFloh’s intuitive platform takes the hassle out of invoice management, ensuring that your financial data is always up-to-date and easily accessible.

Here’s a quick peek at what makes FinFloh stand out:

- Simplified payment workflows that keep your cash flowing smoothly.

- Customize approval tiers to fit your company’s unique structure.

- A full audit trail to keep you in the loop on every transaction.

- Integration with Quickbooks Online and other popular accounting software for seamless financial operations.

With FinFloh, you’re not just staying afloat; you’re sailing towards a horizon of financial clarity and control.

Empowering CFOs and Finance Teams with FinFloh

Automated Follow-Ups for Better Cash Management

Chasing down payments can be a real drag, but with FinFloh, it’s like having a virtual assistant who never drops the ball. Automating accounts receivable frees up staff from the drudgery of manual follow-ups. Instead, they can focus on tasks that really matter, like strategizing for growth. Here’s how FinFloh changes the game:

- Timely reminders: Sends out payment reminders like clockwork.

- Personalized touch: Customizes follow-up messages for each client.

- Smart escalation: Knows when to step up the urgency.

By automating the mundane, FinFloh not only streamlines operations but also helps maintain healthy cash flows—critical for any thriving business.

And let’s not forget the data. FinFloh’s analytics give you a crystal-clear picture of who’s paying on time and who’s slacking, so you can make informed decisions. It’s like having a crystal ball for your cash flow, and who wouldn’t want that?

Integrating with Your Finance Stack

In the ever-evolving world of finance, FinFloh stands out by seamlessly integrating with your existing finance stack. It’s like the missing puzzle piece that effortlessly fits into your financial ecosystem, connecting with various accounting software, CRMs, and payment gateways. Here’s how FinFloh makes integration a breeze:

- Compatibility: Works with major accounting platforms.

- Flexibility: Adapts to your unique workflow needs.

- Security: Ensures data is transferred securely.

With FinFloh, you’re not just adding another tool to your arsenal; you’re enhancing the capabilities of every system it touches.

The result? A unified, efficient, and more strategic finance operation that can adapt to the demands of modern business. Whether you’re a CFO or part of a B2B finance team, FinFloh’s integration capabilities mean less time on manual data entry and more time on what really matters: strategic financial management.

Leveraging Data for Strategic Decisions

In the age of big data, FinFloh turns numbers into narratives that guide B2B finance teams towards smarter, data-driven decisions. By harnessing the power of analytics, FinFloh provides CFOs with the clarity needed to navigate the complexities of modern finance.

With FinFloh, the guesswork is eliminated, and strategic planning is informed by solid data insights.

Here’s how FinFloh makes it happen:

- Cash Flow Clarity: Understand the financial health of your business with real-time dashboards and predictive analytics.

- AR/AP Automation: Streamline your accounts receivable and payable processes for improved efficiency and accuracy.

- Strategic Forecasting: Leverage historical data to forecast future trends and prepare for various financial scenarios.

FinFloh’s approach to data is not just about collecting it; it’s about transforming it into actionable intelligence that can lead to impactful business outcomes. Whether it’s optimizing day-to-day operations or planning for long-term growth, FinFloh equips finance teams with the tools to turn data into a competitive advantage.

In today’s fast-paced business environment, CFOs and finance teams are constantly seeking innovative solutions to enhance their financial operations. FinFloh stands at the forefront of this transformation, offering cutting-edge tools designed to streamline processes and drive growth. By leveraging FinFloh, finance professionals can unlock new levels of efficiency and insight, empowering them to make strategic decisions with confidence. Don’t let your finance operations fall behind—visit our website to discover how FinFloh can revolutionize your financial management.

Wrapping It Up

In the bustling world of B2B finance, CFOs and finance teams are constantly on the lookout for tools that can streamline their processes and boost efficiency. FinFloh emerges as a beacon of innovation, offering a suite of AI-driven features that tackle the complexities of accounts receivable management. Whether it’s automating collection follow-ups or forecasting cash flows, FinFloh is designed to empower financial professionals to stay ahead of the game. So, if you’re looking to elevate your finance team’s productivity and take control of your receivables, giving FinFloh a whirl might just be the smart move you need to make. Remember, in the realm of finance, staying ahead isn’t just an advantage; it’s a necessity!

Frequently Asked Questions

How does FinFloh help with forecasting cash flow?

FinFloh utilizes AI-driven analytics to provide accurate and real-time cash flow forecasts, enabling CFOs and finance teams to make informed decisions and plan for future financial requirements.

Can FinFloh be integrated with existing financial systems?

Yes, FinFloh is designed to seamlessly integrate with a variety of financial systems and software stacks, ensuring smooth data transfer and minimizing the need for manual input.

What kind of support does FinFloh offer for invoice management?

FinFloh provides comprehensive support for invoice management, including automated invoice generation, tracking, and reconciliation, as well as AI-powered tools for managing disputes and ensuring timely payments.