15 Best Credit Repair Software For Business & Personal Use in 2022

You need the best credit repair software because 79% of credit reports contain inaccuracies, four out of every ten people in America have a credit score below 700, and identity theft increased by threefold between 2019 and 2021 and is expected to continue to climb.

Due to the increase in popularity of e-commerce transactions, as well as a significant increase in data breaches, the rate of identity theft is on the rise. The number of documented data breaches continues to rise on a daily basis, according to official statistics.

Mistakes on a credit report, no matter where they come from, can have devastating consequences for a consumer’s ability to obtain credit. Fortunately, the credit repair industry can assist you in monitoring and repairing your credit reports.

We realize how aggravating it may be to have terrible credit because it makes it more difficult to qualify for new credit products in the future. While it may appear like all hope is gone in terms of improving your credit score, remember that it is still possible!

Most of the top credit repair software provides you with a handy option to repair your bad credit and potentially even boost your credit ratings. Individuals and businesses can quickly and easily correct any errors on their credit reports with the help of credit repair software.

What is the Cost of a Credit Repair Software?

The majority of credit repair software solutions will start at a monthly cost of $179, with payment options ranging from $179 to $599 per month depending on features.

That is certainly the case in the business market when it comes to credit software. If you want to restore your own credit score, most personal dispute software will cost you between $19.99 and $99 a month depending on how much work you put in.

You have the option of using free or low-cost items, but the majority of the time you will be forced to upgrade to the premium or professional version. The software and resources you will find here have a monthly cost ranging from $0-$179.

What is the Best Credit Repair Software?

If you’re looking to start a credit repair business you should consider these criteria before getting started.

- Credit Reports Upload & Audit

- You can effectively manage your clients, leads, & affiliates

- Maintain Control Over Your Clients, Leads, and Affiliates With A Comprehensive Library of Dispute Letter Templates and Training

- Capable of Eliminating Charge-Offs, Tax Liens, Collections, Medical Debt, and Late Payments

- Genuine Customer Service That Assists You Throughout The Process

15 Best Credit Repair Software For Business & Personal Use

If you are conducting your own research, selecting credit repair software will require a significant amount of time and work. Fortunately for you, we have compiled a list of our greatest personal credit repair software so that you can stay educated and make the best option for your specific requirements and circumstances.

Here are the 15 best repair software for business & personal use 2022, as determined by our research.

1. Credit Repair Cloud

Best for business and personal use.

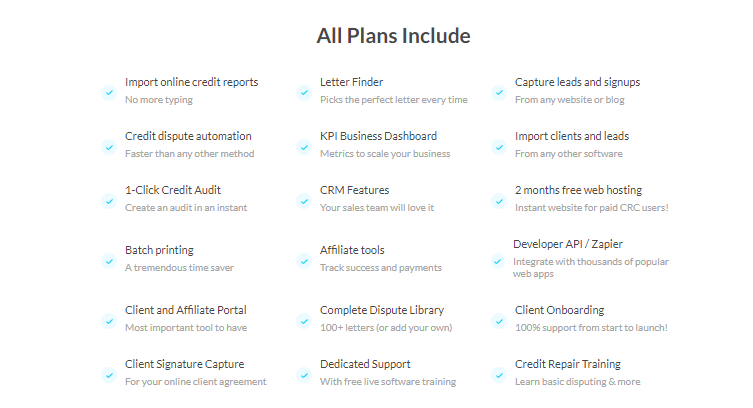

Credit Repair Cloud is a credit repair software that allows you to establish, develop, and expand a business from your home or office. This program allows you to upload credit reports at ease with a press of a button and helps you send out dispute letters in bulk which saves you hours and hours of effort.

Without Credit Repair Software, businesses would have probably needed to hire dispute processors and admin support, but this allows businesses to save money and scale even faster. It works in combination with any Customer Relationship Management (CRM) system and enables you to mend the credit of organizations and people.

Read our Credit Repair Cloud Review.

Key Features

- A free podcast to learn more about the credit repair business

- free book about credit repair solutions

- generate credit audits with 1 click

- Everything may be managed through a single dashboard and CRM

- Complete referral monitoring as part of an affiliate partnership

- Credit monitoring services might help you earn more money

- the Credit Hero Challenge which is a 14-day comprehensive course that teaches you all you need to know to start your own business.

- Credit Repair Cloud Software – Their robust software makes it simple to start and expand a credit repair business. Guess what? You can try it free for 30 days!

- a 6-week training program to help you grow your business.

- Credit Repair Expo — a once-a-year credit repair event where you may hear from industry professionals and meet people who make seven figures.

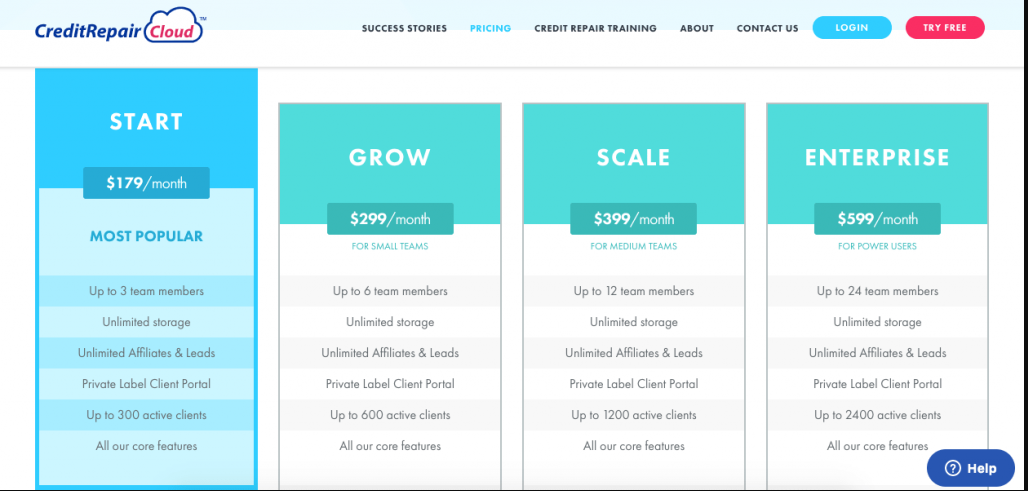

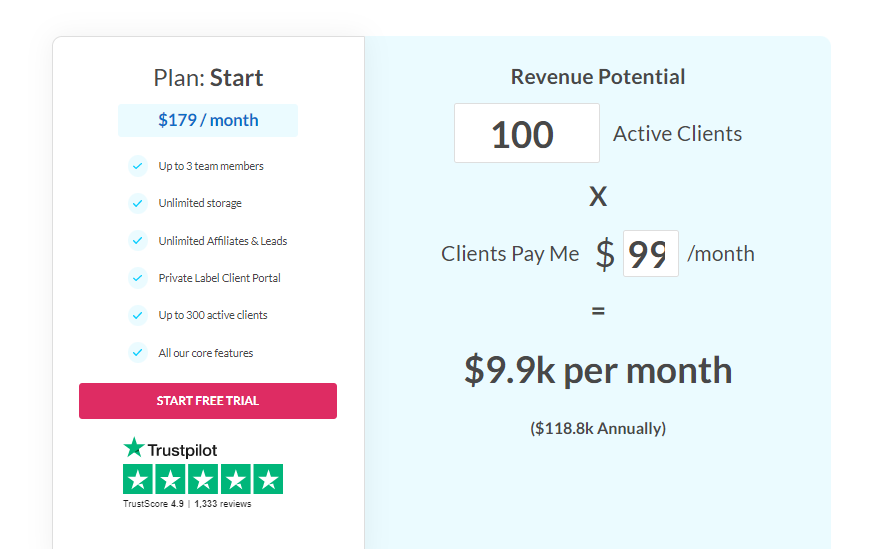

Pricing

Grow Plan: $299/month (best for users who need more active clients)

- Option to add up to 6 employees

- Serve up to 600 active clients

- All core features

Scale Plan: $399/month (Best for those who are scaling fast)

- Add up to 12 employees or team members

- Unlimited affiliates, leads, and storage

- All the core features

- Provide service to up to 1200 paying clients

Enterprise Plan: $599/month

- Add up to 24 employees or team members

- Unlimited storage, affiliates, and leads

- Provide services to a maximum of 2400 high-paying clients.

- Come with all the core features

PROS

- Automates up to 80% of your work

- Billing and affiliate internal software links

- Credit rehabilitation classes that are certified

- There are almost 15,000 people in the community

CONS

- There’s a need to put in some work

- Without adequate supervision, it may be daunting

- Website templates appear to be out of date

2. Credit Saint

Best credit repair software for finance sites.

Credit Saint is a credit repair software that can help you improve your credit by removing bad things from your credit report that should not be there. Among these are things like late payments, identity theft charge-offs, and many more. Credit Saint also helps you get rid of things that hurt your credit score early.

Credit Saint promises that if their credit repair process doesn’t remove any credits in 90 days, they’ll give you your money back. People who work for this debt-relief company get “top-notch” service, like 24/7 access to repair experts. As part of the service, clients are given a dashboard with an analysis score that shows how the disputes are going.

Key Features

It comes with a private dashboard for subscribers

- Free consultation services

- Maintains an A rating from the BBB

No Upfront Fee

- Customized dispute letters

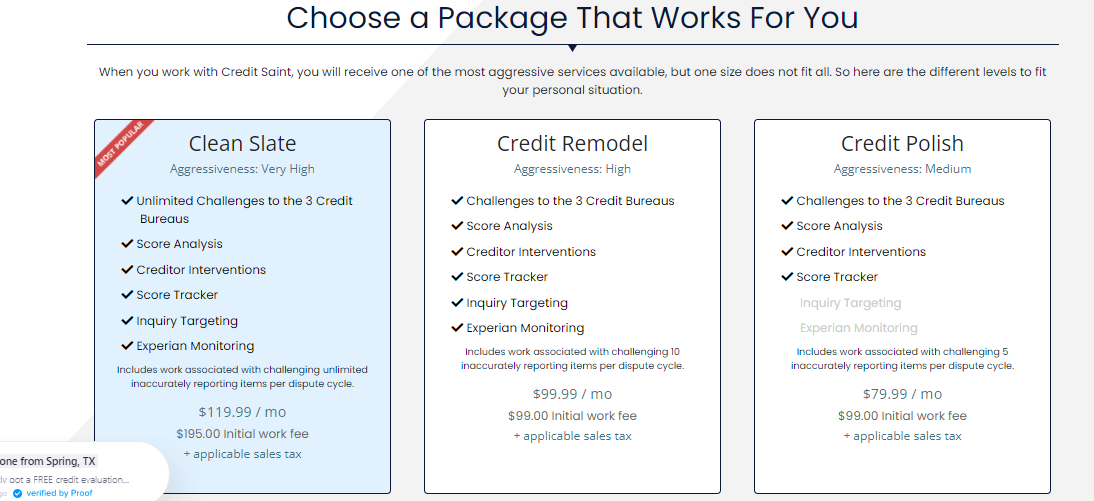

Pricing

Depending on your financial status and the services you desire, you have 3 options with Credit Saint.

Credit Polish – $79.99 a month: this is the entry-level service, which includes challenges to the three major credit bureaus, score analysis, creditor interventions, and a score tracker.

Credit Remodel — $99.99 per month: this is the medium option, which includes all of the features of Credit Polish plus inquiry targeting and Experian monitoring. You may only pick up to 10 inaccurate items from each dispute cycle you want to erase with the Credit Polish plan.

Clean Slate – $119.99 per month: Credit Saint’s most expensive yet popular plan. Everything from the first two bundles is included, with the exception that you can dispute an infinite number of incorrect things.

PROS

- BBB accredited

- 90-day money-back guarantee

- Personalized customer service

- Removes every questionable negative item

CONS

- Prices not readily available

- Doesn’t cover all 50 states of the United States

- High work fees at the start

- Lacks educational infographic on the website

3. SkyBlue Credit

Best credit repair software for a couple of discounts.

Sky Blue, situated in Florida, is a recognized and competent credit rehabilitation organization. It is aimed at consumers who are searching for a low-cost option to assist them to erase negative things from their credit reports. In the event that the intended results are not reached, the firm will refund your money.

Key Features

- Provides a single plan that can be changed.

- Free of charge, the company gives you a 90-day guarantee without restrictions.

- Membership can be cancelled or put on hold at any time. The base services include credit analysis, disputes, and score rebuilding.

- It includes things like mortgage preparation, debt verification and goodwill letter preparation.

- It comes with a BBB Rating: C-

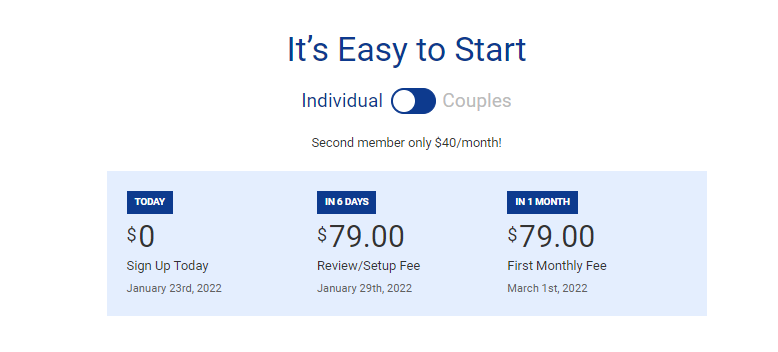

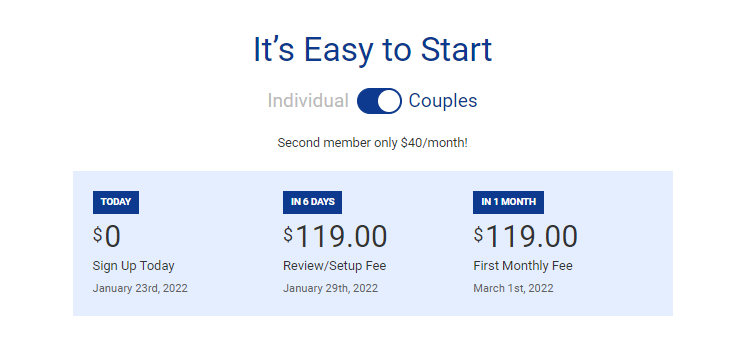

SkyBlue Credit Pricing

Credit repair with Sky Blue is quite inexpensive and simple. The company has a single straightforward price plan that costs $79 per month plus a $79 setup charge. The setup cost, however, is not collected immediately after you sign up, but rather six days later. Similarly, the monthly price is charged once a month.

Sky Blue is one of the few trustworthy credit repair software that gives couples discounts. You’ll be charged a $119 monthly cost plus a $119 one-time setup fee if you opt to enroll with your partner.

If you are unhappy with Sky Blue’s services, you may cancel your membership at any time without penalty or additional expenses.

PROS

- Simple pricing structures

- Customized controversies and services

- Money-back guarantee for 90 days

- It’s simple to cancel or stop your subscription

CONS

- Few monthly disputes

- Low BBB rating : -c

- Lacks financial management tools

4. Lexington Law

Best for lawyers as well as law institutes

Lexington Law is a full-service law practice located in Utah that assists customers with credit disputes, credit score and report research, and dispute escalation to help them remove erroneous or disputable negative entries from their credit reports. Your credit history will be cleaned of unfair or deceptive bad items in only a few months.

Lexington Law’s credit repair software’s procedure is engaging with credit agencies on your behalf to dispute erroneous information on your credit report. Because the Fair Credit Reporting Act requires credit bureaus to record only verified and accurate information, any items that do not fulfill these requirements will be removed.

Key features

- Consultation is provided without charge

- Service plans that are simple to understand

- Legal professionals with a lot of experience

- Long and successful track record

- Options for contacting them online

- Employs attorneys and paralegals

Pricing

Concord Standard, Concord Premier, and PremierPlus are the three pricing plans offered by Lexington Law’s credit restoration professional, with fees ranging from $89.85 to $129.95.

The Concord Standard plan corrects any incorrect negative items on your credit report and provides creditor interventions to correct negative items.

The Concord Premier plan provides individualized dispute resolution as part of the Standard plan, as well as a number of additional services. You’ll get features like InquiryAssist, report watch, monthly credit score analysis, and TransUnion notifications with this package.

The PremierPlus package is the most popular option for removing credit inquiries because it adds a new set of services to the Concord Premier plan. You’ll get cease and desist letters, identity protection, a FICO score tracker, and financial tools if you purchase this package, which will help you make better decisions in the future.

PROS

- Credit counseling and analysis of the highest quality

- Customer service is outstanding

- More than 15 years of experience

CONS

- There is no BBB rating.

- The pricing strategy isn’t communicated properly

- A lawsuit has been filed against the corporation

5. Ovation Credit Services

Best for individuals or professionals looking for educational resources

Ovation Credit Services, a subsidiary of LendingTree, has been in business for over 15 years. As a result, the name has a lot more weight than the names of other credit repair software we’ve looked at. This organization claims to cure an average of 19 issues per customer, has simple pricing, and even provides free evaluations to its visitors.

Key Features

- There are two pricing options available, as well as complete cost transparency

- Discounts for couples, pensioners, and military personnel are available

- Provides credit monitoring services

- Tools for financial planning are available

- A renowned corporation owns and operates it

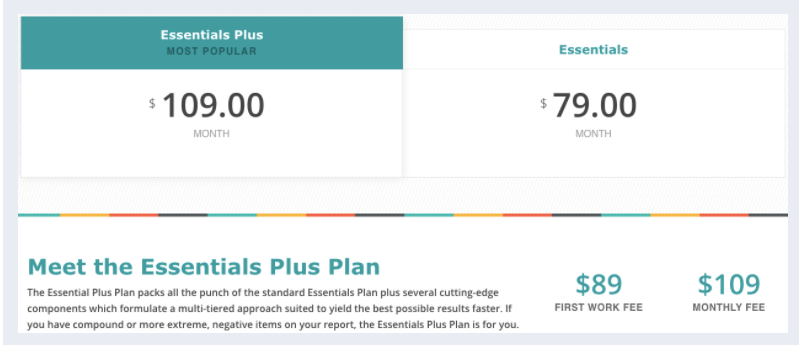

Pricing

You’ll be given two alternatives once you’ve completed your free evaluation and decided to continue with the paid service. The first option is the Essentials package, which costs $79 per month. Essentials Plus is the more expensive option, costing $109. Both options include an $89 initial work cost, which is charged one week after you sign up for credit repair software services.

PROS

- Dedicated case consultant

- Free credit evaluation

- Service cancellation is possible at any time.

CONS

- Only phone applications are accepted

- There is no money-back guarantee

6. Trinity Credit Services

Best for individuals personalized credit-restoring solutions.

Trinity Credit Services is a local credit repair software that serves only residents of Texas and Louisiana. This company offers more specialized services, such as loan approval advice and employment background checks, in addition to typical credit restoration. Trinity Credit Services is known for delivering one-on-one help and services that are targeted to the specific needs of each client.

Key Features

- Personalized service to suit a variety of objectives

- Evaluation of your credit report for free

- Client portal that is simple to use and has no monthly fees

- Certified under the Fair Credit Reporting Act

Pricing

According to our study, Trinity Credit Services charges a one-time upfront fee rather than a monthly fee. The price is determined after the company examines your credit reports and determines how difficult it will be to resolve your credit concerns. This business, like many other credit repair software, offers a no-cost introductory consultation. If you choose to pay for the service, you’ll be locked into a six-month contract and charged between $400 and $600.

PROS

- Credit rehabilitation strategies that are tailored to your needs

- Guaranteed money-back

- Guide to Credit Survival

CONS

- Only in Texas and Louisiana

- Applications are through phone

7. Credit Firm

Best for individuals seeking cheap credit repair software.

Credit Firm is a Texas-based credit company that was founded in 1997. It is one of the oldest and best repair credit companies, but it only has a C+ rating from the Better Business Bureau. The company offers a single credit repair plan with no additional services. Nonetheless, it provides toll-free phone support and free consultations 24 hours a day, seven days a week.

Key Features

- Free credit evaluations and consultations are available

- It is available in all 50 states

- There is no limit to the number of incorrect items that can be repaired

- Pricing that is competitive

- Customer service is available 24 hours a day, seven days a week

Pricing

Look no further if you’re looking for low-cost credit repair software. Credit Firm will clean up your credit reports for only $49.99 per month. The first payment will be charged five days after you sign up, and the next payment will be due 30 days later. There are no hidden fees, and you can cancel at any time.

Couples who enroll together receive a $10 discount on their monthly payments. Given that the price is already so low, even a small discount like this is commendable.

PROS

- Pocket-friendly

- Quick service

- Licensed and experienced attorneys

CONS

- There is no credit monitoring

- There are no financial management tools

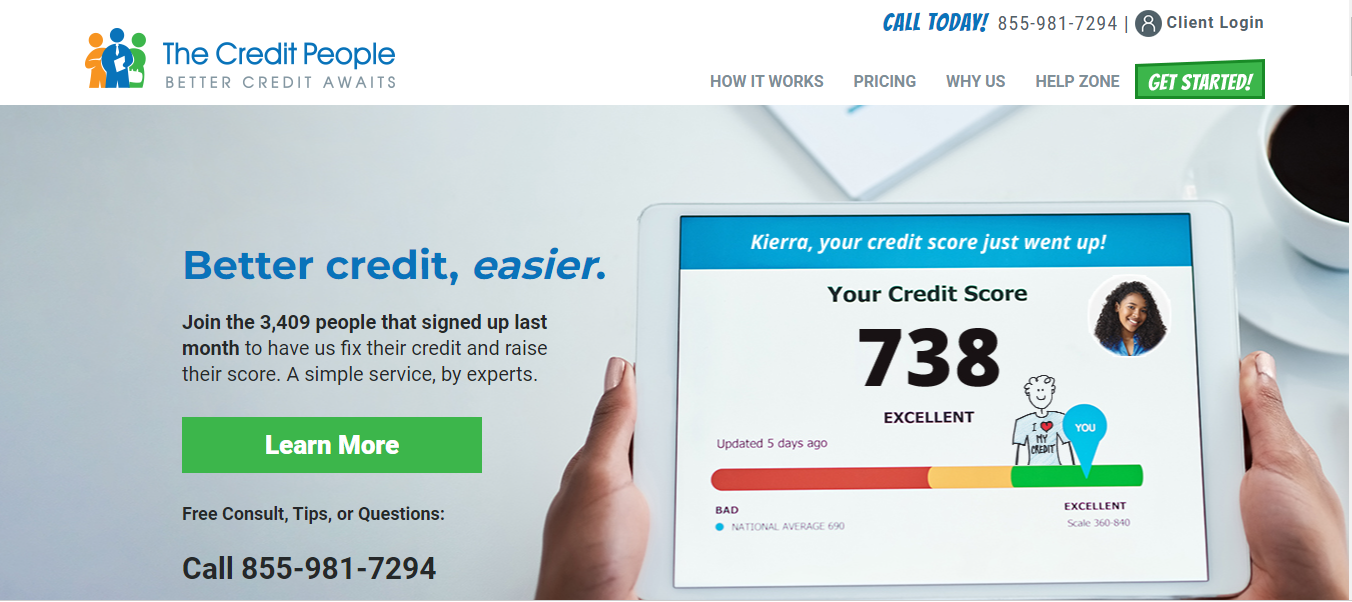

8. The Credit People

Best for swift services.

The Credit People is a firm that can help you swiftly repair your credit. Clients in more than 50 states, including Washington, DC, use this organization’s services.

It effectively works with credit reporting organizations to decrease unfair and negative credit. This firm’s website allows you to easily obtain your credit report.

Key Features

- Provides both a flat-rate and a monthly membership plan

- Low one-time start-up costs

- Well-educated financial advisors

- Disputes an infinite number of incorrect items

- Account accessibility is available 24/7

Pricing

Let’s take a look at why this is considered one of the most economical credit repair software available. First and foremost, the registration fee is only $19. This is the most affordable offer we’ve found, beating out all other firms by a wide amount. Then there’s the price scheme. You can either pay $79 per month for a monthly plan or $419 for a six-month subscription.

The service is the same regardless of the option you select. The only stumbling block is if you intend to utilize the service for more than six months. Because many people believe that six months is the ideal time to improve your credit score, many clients opt for the flat rate package, saving more than $70 in the process.

PROS

- No limits to the number of disputes

- Excellent educational resources

- There is a flat rate available

CONS

- There are no financial management tools available.

- There will be no credit monitoring

9. Pinnacle Credit Management

Best for fast and ‘aggressive’ credit repair software.

Pinnacle Credit Management is one of the best and fastest credit repair software, specializing in the removal of collections, late payments, tax liens, medical bills, bankruptcy, student loans, and other credit-related concerns. Pinnacle works with a variety of lenders and financial organizations to help its clients. They will have more options to secure a loan or mortgage once their credit has been rehabilitated.

Key Features

- AI-assisted credit repair software

- Free credit counseling and online educational materials

- Connects clients with lending partners

- Refund policy of 60 days

- Quick service

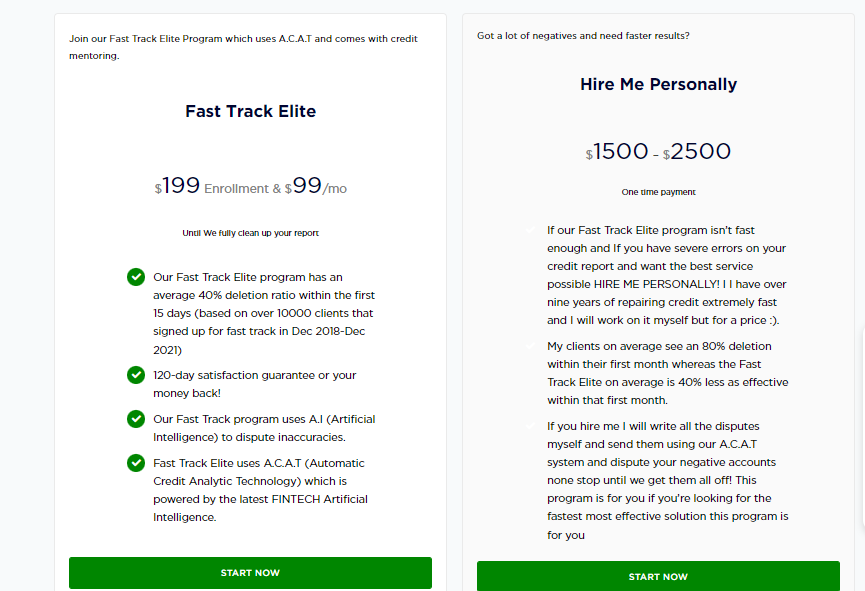

Pricing

Pinnacle Credit Management is the best firm to repair your credit if you’re ready to put out the effort. Fast Track and Fast Track Elite are the two price plans offered by the company. The Fast Track plan has a $99 monthly price and a $199 one-time setup fee. Your credit will be repaired in three to six months, and you can terminate the service at any moment.

Fast Track Elite is significantly more expensive, with a one-time fee of $1,500-$2,500 plus a $199 upfront fee. The restoration of your FICO score, on the other hand, takes roughly 15 to 30 minutes. A personal credit manager, monitoring service, and a 120-day satisfaction guarantee are also included.

PROS

- AI-assisted process

- Credit mentors

- Free educational materials

CONS

- High start-up costs

- No credit monitoring

10. The Credit Pros

Best Bonus Features

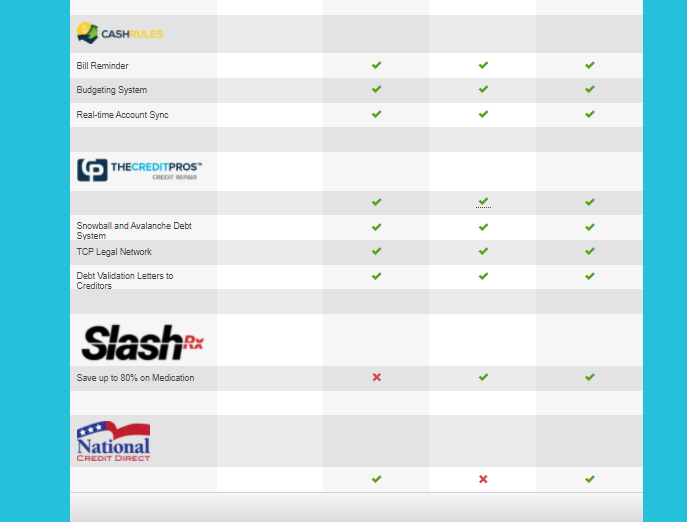

Credit Pros is a law firm based in New Jersey that specializes in eliminating negative entries off credit reports by sending unlimited dispute, debt validation, and goodwill letters, as well as cease and desist letters. It was founded in 2009. In addition, the firm provides one-on-one consultations and assistance, as well as financial management tools that help clients make better credit decisions.

Key Features

- Both credit restoration solutions include credit monitoring

- Resources for financial management are included

- FICO professionals are at your service with a mobile app for iOS and Android

- You have the option to cancel the service at any time

Pricing

Although there are four programs available, two of them are not intended for customers who require credit repair software. As a result, we’ll only look at the $119/month Prosperity Package and the $149/month Success Package.

Surprisingly, there are no fees associated with signing up for this credit repair service or doing the initial job. You may also buy credit monitoring as a separate service for only $19 per month if that’s all you need.

PROS

- Credit disputes are unlimited

- Several additional services are available

- Support via live chat

CONS

- There is no money-back guarantee

- Poor website user experience

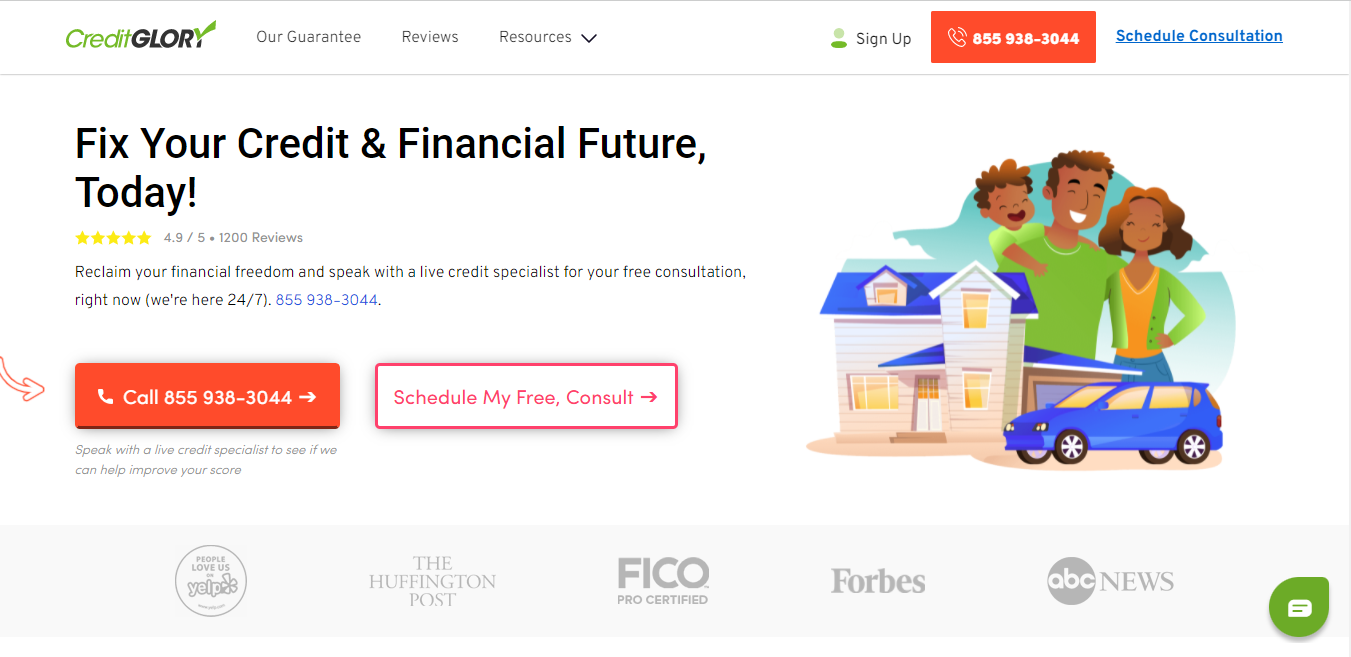

11. Credit Glory

Best for individuals seeking affordable credit repair fees.

Credit Glory was created by persons who worked for one of the country’s leading debt collection companies and learned everything there is to know about the industry. As a result, they are particularly qualified to defend you in court. Most credit restoration firms would promise you the moon, but not Credit Glory – the company’s operations are totally transparent, and if its personnel are unable to assist you, you will be informed immediately.

Key Features

- Aids in the resolution of concerns relating to identity theft

- Provides a free 15-minute consultation

- Pricing plans that are completely transparent

- Customer service is available 24 hours a day, 7 days a week, and there is a 90-day money-back

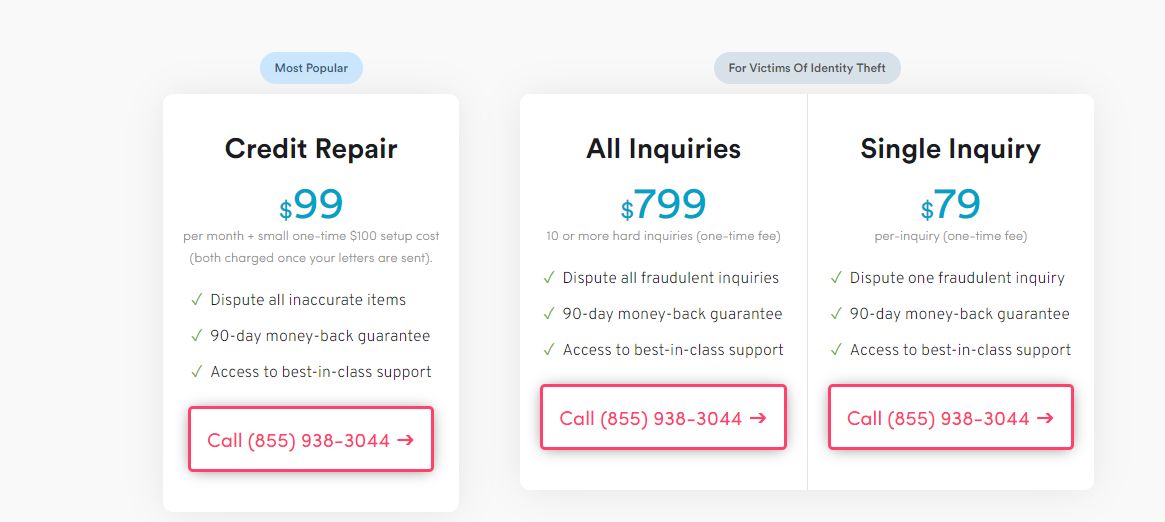

Pricing

Credit Glory, being one of the best credit repair software, will not charge you an arm and a leg for its services, but it isn’t the most economical option either.

The provider’s first solution, Credit Repair, is the only option that is paid on a monthly basis. This subscription, which costs $99 per month plus a one-time setup fee of $199, includes unlimited dispute letters.

If you choose the All Inquiries package, Credit Glory’s services will cost you a total of $799.

Finally, there’s the Single Inquiry package, which is ideal for folks who only require the removal of a single credit mark. This option will cost you $79 per item if you choose it.

One of the advantages that distinguish Credit Glory from the competition is the ability to cancel the service at any time.

PROS

- Disputes fake inquiries

- Customer service is available 24/7

- Insight into debt collection agencies

CONS

- Does not obtain your credit reports on your behalf

- There are no credit monitoring services available

12. Credit Assistance Network

Best for fast theft identification

Security clearance aid, identity theft resolution, settlement offer support, and one-on-one credit coaching are among the services provided by Credit Assitance in addition to credit restoration. A skilled credit consultant will check your credit reports after you sign up and highlight anything that needs to be verified or contested.

Each credit bureau will receive up to 45 disputed items per cycle, according to the company’s goal. Instead of using pre-written letters, a credit consultant creates each dispute letter by hand to ensure that it is accurate and consistent with the facts.

If the source of a negative item is unable to verify the facts, the bad item is removed from your credit report. Creditors and collectors have 30 days to verify the information, and Credit Assistance Network will aggressively pursue any missed deadlines or legal infractions.

Until your credit reports are free of errors, false-negative entries, and duplicate information, the company will contact you to close the account. You won’t be charged for services you don’t require. You can also save money by signing up with a spouse or friend and receiving a discount on the regular service fee.

Key Features

- 90-day 100% money-back guarantee

- There are no monthly charges

- Positive customer feedback

- Provides credit monitoring service

- Financial calculators for mortgages and loans

Pricing

Credit Assistance Network, unlike other credit restoration companies, does not charge a monthly fee. Instead, it costs $50-$75 for each disagreement that is resolved (the former is related to deletion per bureau, the latter per public record). A setup fee of $179 for singles and $279 for couples is also charged by the company.

Credit Assistance is a fantastic credit cleaner for clients who don’t have many disputes, as they may be resolved quickly and without spending a lot of money, according to its unusual price model.

If Credit Assistance is unable to resolve any of your credit issues, they will refund your money.

PROS

- One-on-one consultations

- Personalized service

- Educational material is available for subscribers

CONS

- High one-time charges

- BBB rating is low

- Incorrect information on the website

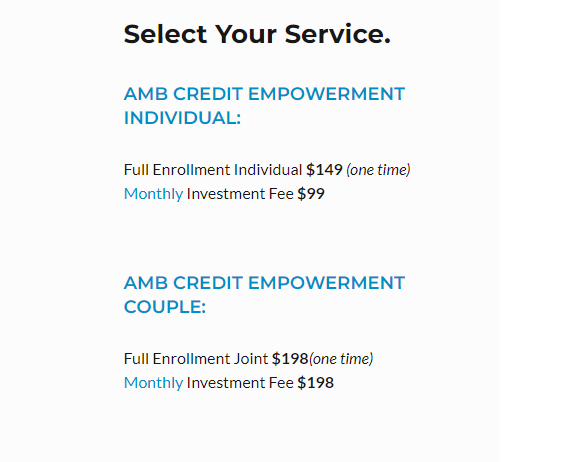

13. AMB Credit Consultants

Best for individuals seeking user education on credit repair software

AMB Credit Consultants seeks to help customers learn more about money through its financial literacy classes. According to the company’s website, they want to help people make good credit decisions that last a long time.

Key features

- Credit repair software services from AMB begin with a credit consultation

- Consumer education

Pricing

PROS

- Unlimited disputes

- No consumer complaints

- Offers online portal

- Discount for couples

CONS

- Excessive fees- enrollment costs $149, with monthly fees of $99

- No free consultation

- Single service option

- Requires credit monitoring for an additional fee

- Few online resources

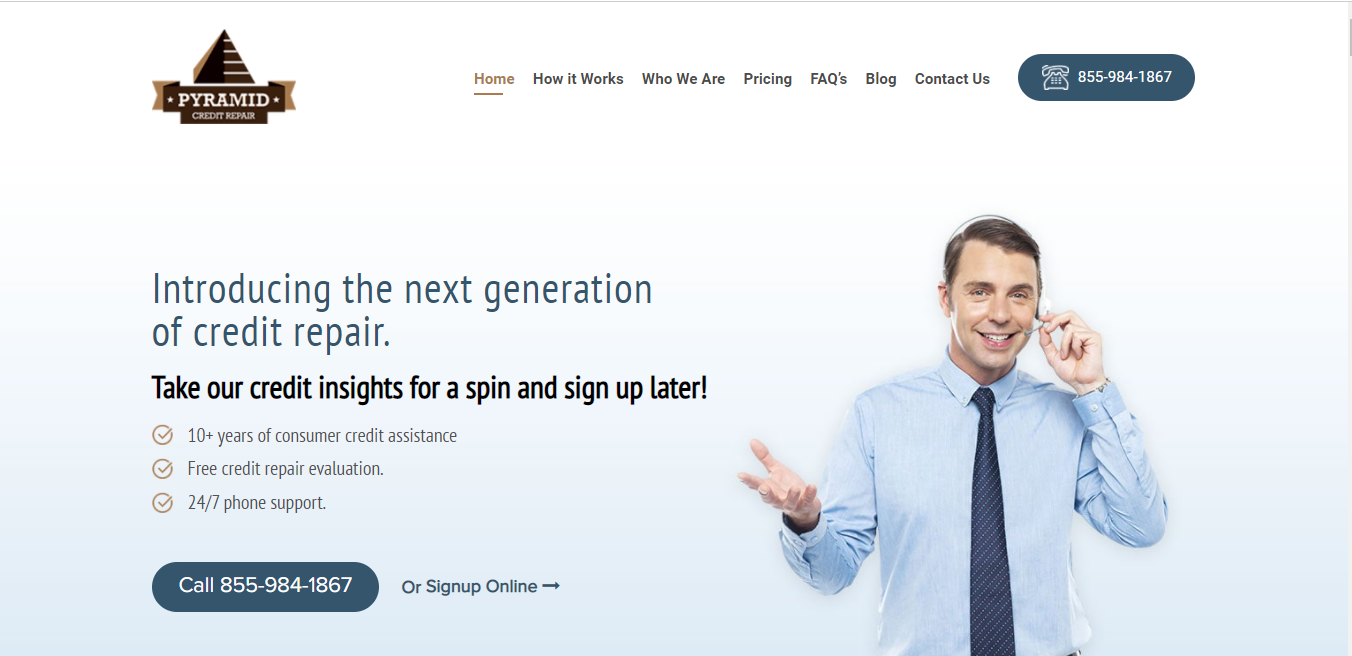

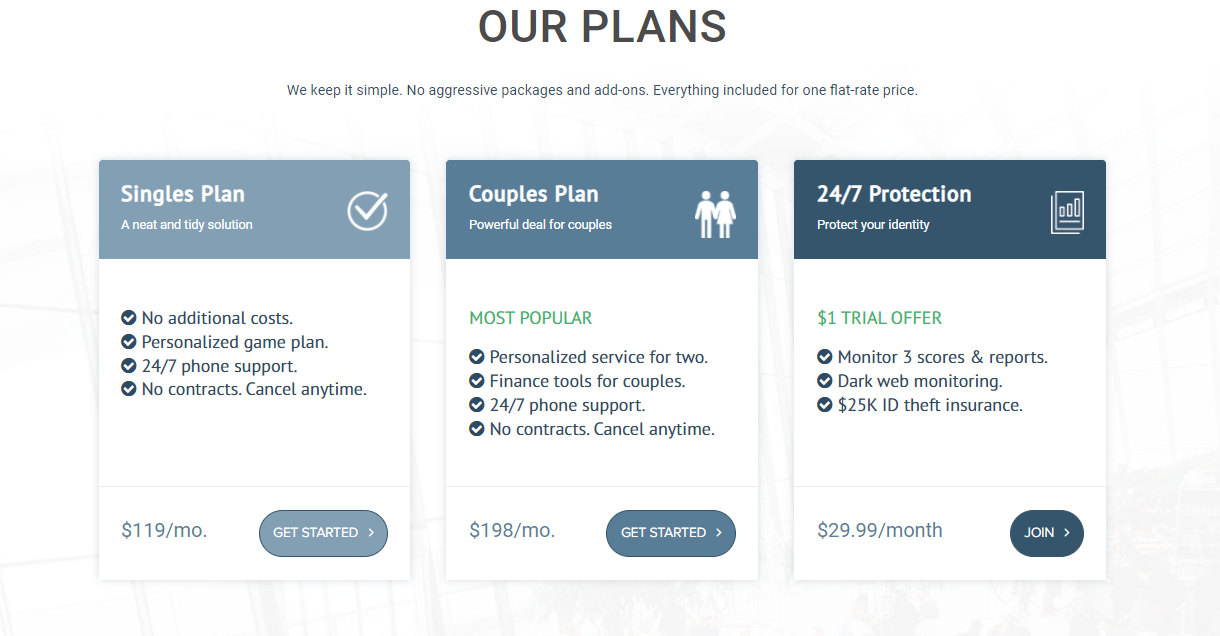

14. Pyramid Credit Repair Software

Best Customer Service and Married People.

Pyramid Credit Repair software has a decade of expertise in assisting consumers with credit repair. In addition to its rigorous credit challenge procedure, the organization places a strong emphasis on customer education. A single’s plan costs $99 per month, while a couple’s package costs twice as much.

Key Features

- Provides a three-step credit repair process

- Support is available 24/7 via phone, email, and text

- A 90-day money-back guarantee is available

- Clients deal with account managers who are devoted to them

- Access to a team of licensed attorneys

Pricing

Pyramid has 2 distinct price packages. The Singles plan is $99 per month, while the Couples plan is $198 per month. Pyramid does not demand a contract for its services, so you can stop using them at any moment. You won’t be charged any additional hidden costs if you choose Pyramid Credit Repair software to clean up your credit.

IdentityIQ provides 24/7 identity protection through Pyramid Credit Repair. You may test it out for $1 for the first week. If you are happy with your experience after the first seven days, you may continue to be protected for $29.99 each month.

Current and past members of the United States military are eligible for a 20% monthly discount. Pyramid Credit Repair software is also one of the more cost-effective credit repair choices for instructors. Each instructor who registers receives a 15% discount.

PROS

- Pay-as-you-go

- Round-the-clock customer service

- Credit repair evaluation is free

CONS

- Unavailable in 12 states of the United States

- Isn’t BBB-approved

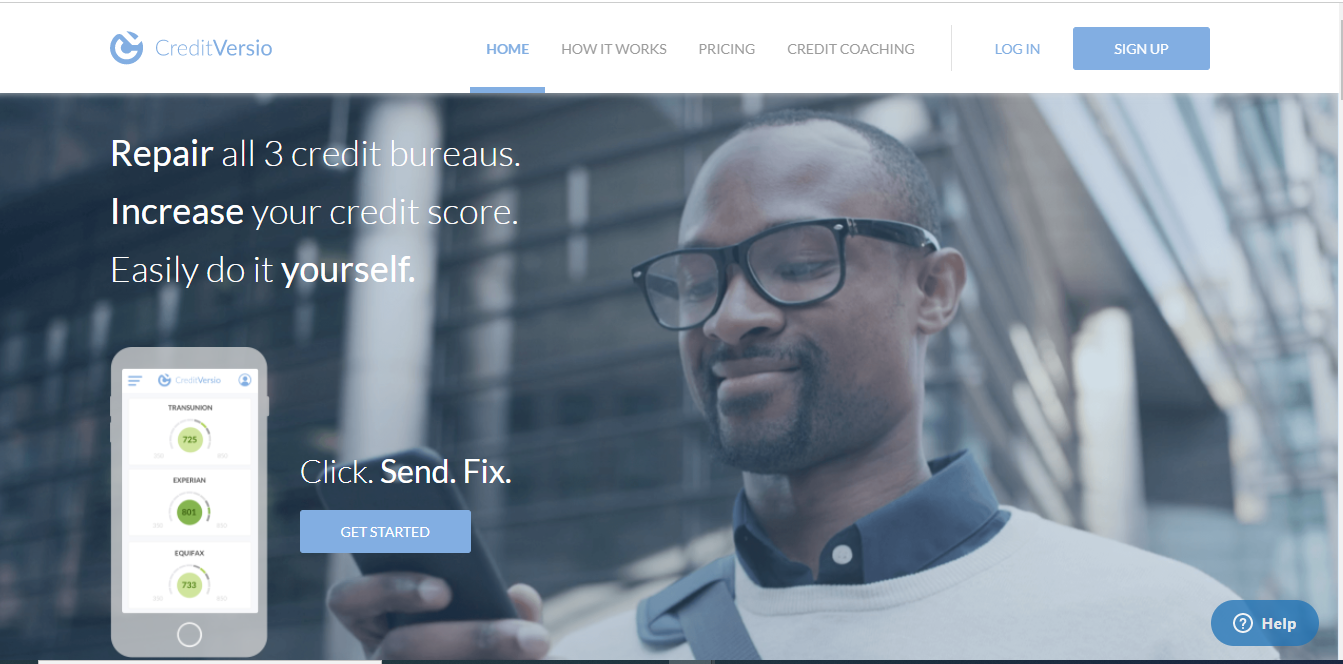

15. Credit Versio

Best for individuals who wish to have a DIY credit repair software

Credit Versio is a do-it-yourself credit record repair and monitoring program. This program is created for novices and is readily accessible from any device. You don’t need to be tech-savvy to utilize it. Credit Versio’s services are cheaper than those offered by other credit repair organizations. The company’s high-tier price plan is a mere $29.99 per month.

Key features

- Provides online dispute resolution and credit repair forms for do-it-yourself users

- There are three price options available

- Allows you to send a dispute letter to each of the three main credit bureaus

- Credit monitoring and notifications

- Service that is reasonably priced

Pricing

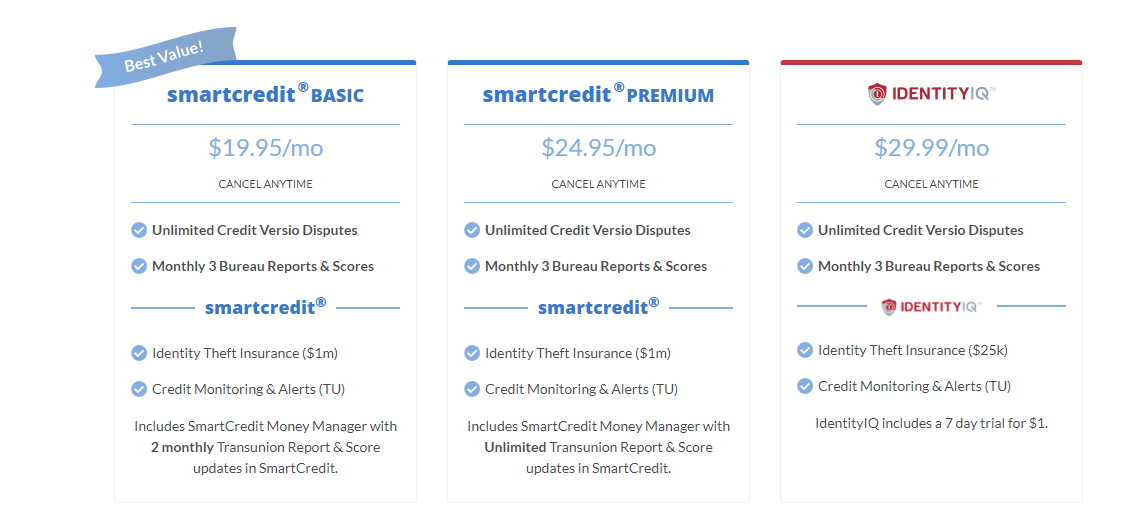

SmartCredit Basic, Premium, and IdentityIQ are the three pricing options offered by Credit Versio. Each permits you to file a dispute with the main credit bureaus. The key distinction is the number of credit reports you can obtain and the number of credit disputes you may file each month.

The Basic package ($19.95 per month) includes a credit report from each of the three main credit bureaus, as well as $1 million in identity theft insurance and credit monitoring tools. When you notice erroneous information on your credit report, you may file two disputes each month using this version. You are only allowed to obtain two credit reports every month.

This is the industry norm, and some reputable credit repair software restrict monthly disputes to two. The average consumer considers a monthly dispute limit of two to be too low, therefore you’ll likely choose a higher-tier price plan.

Everything included in the Basic plan, plus an unlimited number of credit inquiries and disputes is included in the second-tier subscription. It will set you back $24.95 every month. The Credit Versio package now includes enhanced identity theft protection with the freshly announced IdentityIQ plan ($29.95 per month).

PROS

- Easy to navigate dashboard

- Excellent customer service

- Competitive pricing

CONS

- Limited disputes

- There are no licensed attorneys

Conclusion

Repairing a consumer’s credit score is a complicated process, and locating the finest credit repair software can take time. Still, rather than opting with the first option you come across, it’s critical to conduct your homework and compare multiple services.

If you don’t think about any of the above, you can end up wasting a lot of time and money on a lousy service.

Finally, if you decide to use credit repair software, make sure you don’t get taken advantage of. Remember that credit repair software shouldn’t receive payment until after they’ve completed your job, however, some do charge setup fees to get around this restriction. Customer reviews might assist you in avoiding scams.