The Ultimate DisputeBee Review in 2022

Disputebee has only been in existence for a few years. How does it compare to other credit repair tools?

It can be difficult to know where to begin in the credit repair software industry because it is so competitive.

When starting a credit repair business, it is critical to understand how to draft dispute letters and make phone calls in order to have those complaints removed.

However, if you are a complete novice or a seasoned professional looking to save time, you can benefit from using our automated dispute management tool/Credit Repair Software instead.

Want to start your own credit repair firm or send out your own credit repair dispute letters? Here’s how.

It is possible to start your own credit restoration business with the help of DisputeBee’s business plan without having to go through the inconvenience of hiring a credit repair firm.

This article will provide an overview of DisputeBee, as well as for instructions on how to utilize DisputeBee to produce disagreement letters.

Let’s take a look at our in-depth Disputebee review. But before we do that, here’s a quick breakdown of what this review will be covering.

- What Is Disputebee?

- How Does Disputebee Work?

- Disputebee pricing

- Who Is DisputeBee Made For?

- DisputeBee Pros & Cons

- Is DisputeBee Legit?

- DisputeBee Training

- DisputeBee alternatives

- Conclusion

What Is Disputebee?

DisputeBee is an automated customer relationship management (CRM) dispute software that allows users to create and track disputes. If you are a newbie in credit restoration, you may have a basic understanding of what a dispute is and how it affects your credit score. Allow me to explain what I’m talking about.

You don’t need complicated software to start a credit repair firm; you could certainly use spreadsheets at first, but it is recommended that you start with some form of customer relationship management program. One that your company can expand into.

It is possible to send out dispute letters on an automated basis with DisputeBee while simultaneously checking your credit score and following up on your results. That is what good credit repair software is all about!

A personal credit repair plan is available for individuals who are looking to repair their credit or give it a try, and a business credit restoration plan is available for those who want to launch a full-fledged credit repair company.

When you conduct an audit of your credit report, you may discover unfavorable information or entries that you did not make. Among the many types of debt are collections, credit inquiries, late payments, bankruptcies, medical bills, and so on.

Therefore, you must file a dispute with the appropriate credit agencies (Experian, Equifax, or TransUnion), which have been identified. Specifically, in the dispute letter, we point out the error and provide supporting proof, and we ask the credit bureau to recheck and remove that item from the report.

Who is the Founder of Disputebee?

Lee Schmidt is the creator of DisputeBee. Lee Schmidt started DisputeBee in 2018 because he wanted to discover a solution to make the credit restoration process easier for both personal and corporate use. Lee Schmidt is also mentioned as the CEO on the DisputeBee home website.

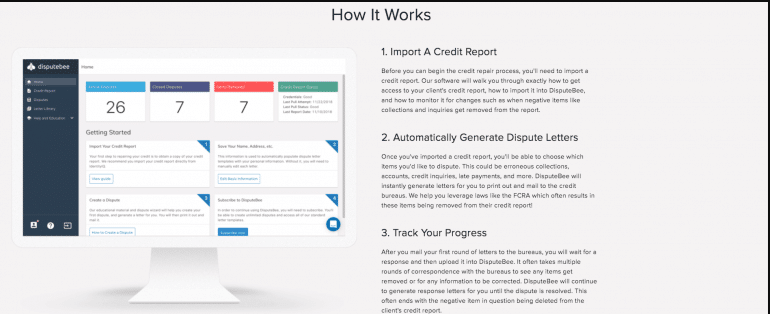

How Does DisputeBee Work?

1. Import your credit report

The software guides you through the process of accessing and uploading your clients’ credit reports into DisputeBee.

2. Generate dispute letters

After that, you go over the reports and select which items you want to contest. You should challenge incorrect information such as street addresses, collection accounts, inquiries, and any other deceptive information.

If you want to make any changes or add any more information to your letter, you may utilize the edit tool to do so (which we recommend so that it seems completely real). You can print the letter and mail it to the appropriate agency once it looks good.

3. Keep track of how your disputes are progressing

Simply submit the information into DisputeBee when the credit bureaus react to your disputes, then wash, rinse, and repeat the procedure.

Of course, we’re only scratching the surface because there are complex strategies for effectively disputing with credit bureaus, but the software will get you started.

Oftentimes, it is preferable to write the dispute letters by hand. Simply print it from DisputeBee and do it yourself or have an agent do it for you. Allow them to personalize the dispute letter. That way, it appears less automated.

DisputeBee assists you in resolving conflicts with all three agencies (Experian, Equifax, and TransUnion). Typically, many rounds of interaction with credit bureaus are required to ensure that the item is deleted off your credit report. Do not surrender after a few rounds.

In general, it takes roughly 30 days for agencies to review a letter of Dispute. If you haven’t already read our guide on beginning a credit repair business from home, we strongly encourage you to do so as it is jam-packed with information on how to get your credit repair business off the ground!

DisbuteBee Pricing

Credit repair is an enticing and lucrative industry, but repairing credit repair on its own is not straightforward. Thus, anyone looking to improve their credit ratings or establish a credit restoration business can utilize DisputeBee.

Consider the following features for both personal and corporate use before deciding to utilize DisputeBee.

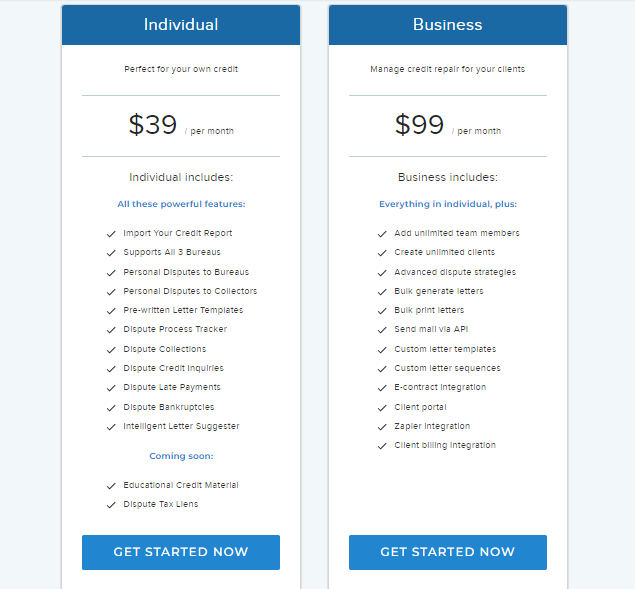

a. Individual plans

Individual plans are ideal if you intend to use DisputeBee solely for personal purposes. It works with three credit bureaus and provides tracking to assist you in improving your credit score. You may create Dispute letters for credit bureaus, credit card providers, and collectors with the individual plan.

The pre-formatted and intelligent letter suggester simplifies the process of composing personalized dispute letters.

Added services include assistance with collection disputes, late payments, and even bankruptcies.

We adore DisputeBee because of its affordability and value for money on the individual plan. Individual plans start at $39 per month. Additionally, it is an excellent option for do-it-yourself credit repair when compared to other credit repair options.

For additional information, see the DisputeBee website.

The business plan is ideal if your client repair business is expanding; it covers all the advanced tools and tactics that streamline your work. Additionally, you can expand the team indefinitely and create a client portal, which is a benefit of the private label.

b. Business plan

Owning a credit repair business would require you to be extremely organized in order to run it properly. You’ll continually have new clients overlapping with existing ones, and you’ll need to keep track of all of their information. As a result, it can and will become quite tough.

The business plan on DisputeBee enables you to easily establish this critical organization. In comparison to the individual subscription, you can instantly add an infinite number of clients.

All you need are the credit records of your clients. Additionally, business owners can expand their teams (employees).

Advanced dispute resolution tactics enable you to manage all of your bulk disputes and write bulk letters in bulk, saving you time and generating additional business. Not only may mass letters be generated, but these letters and their sequences can also be customized.

Here are some additional elements included with the business plan:

- Add unlimited team members

- Create unlimited clients

- Advanced dispute strategies

- Send mail via API

- Custom letter templates

- Custom letter sequences

- E-contract integration

- Client portal

- Zapier integration

- Client billing integration

- Bulk generate letters

- Bulk print letters

Who Is DisputeBee Made For?

DisputeBee is built for anyone who wants to repair their own credit or perhaps establish their own credit repair business by automating the process (diy credit repair software). It is one of the top credit restoration software for businesses as well as a professional credit repair program.

DisputeBee saves time by sending dispute letters and club disputes to the same bureaus automatically. It’s ideal if you have a large number of disagreement letters to file, and honestly, it’s uncommon to resolve conflicts in the first few attempts. Therefore, it is optimal for folks to acquire the DisputeBee software and generate as many dispute letters as desired.

However, if you only have a few dispute letters to send, save money by writing a flawless dispute letter on your own.

Credit repair is popular as a side hustle due to its high profit margins. However, the dispute writing procedure becomes difficult when hundreds of dispute letters must be written for your clients. This approach can be simplified by just clicking on DisputeBee’s business plan.

The only drawback is that you must manually follow up on each dispute letter, which is a time-consuming operation. However, as a credit repair business software with automated and professional dispute management tools, it is an excellent platform.

DisputeBee is an excellent tool for both people and business owners.

DisputeBee Pros & Cons

DisputeBee, like any other piece of software, has its advantages and disadvantages. Although the program has the best features, the business plan may appear to be expensive; especially if you have a small number of clients.

Individual characteristics are limited in comparison at times, but generally it is a terrific and worthwhile photo to take.

The disadvantages aren’t the only ones; there are other advantages to using DisputeBee Credit Repair Software. Our favorite features are the automated feature, intelligent letter suggester, and bulk letter generator.

PROS

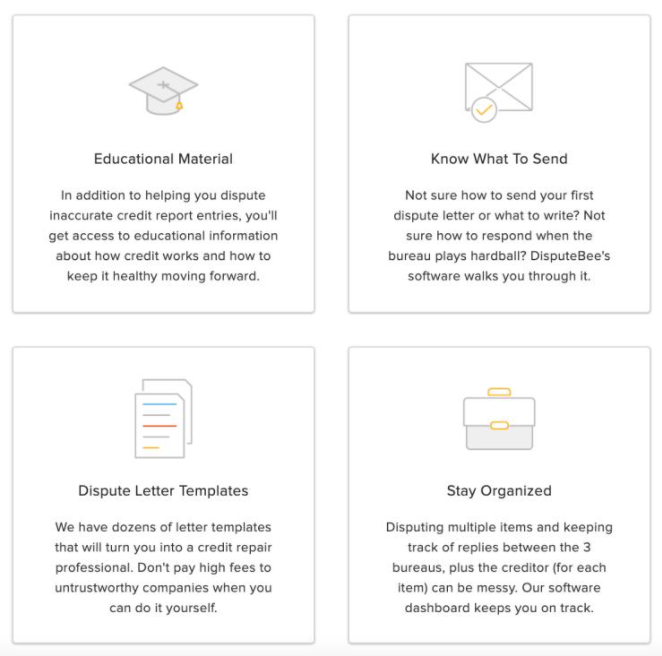

- Delivers educational information

- Create unlimited clients

- Supports all 3 bureaus

- Pre-written letter templates

- Dispute process tracker

- Remove negative items and increase credit scores

- Interactive dashboard

- Add unlimited members

CONS

- High cost

- Results take time

DisputeBee Training

DisputeBee does offer step-by-step video training and in-depth written content to help you become more knowledgeable about the credit repair sector.

Once you sign up for the monthly subscription, you’ll be greeted with onboarding and educational films to ensure your dispute is successful.

Having a tool is insufficient when starting a credit repair business. Credit repair software DisputeBee provides dispute training and other tools.

Though there are numerous YouTube videos explaining how to utilize DisputeBee, there are some additional resources that make the program simple to use. When you purchase the DisputeBee software, you gain access to these resources.

These tools include step-by-step videos on how to effectively send disagreement letters and use DisputeBee.

Is DisputeBee Legit?

Without a doubt! DisputeBee is completely legitimate and operates in the same manner as any other credit repair program. This tool teaches you the regulations governing the credit repair industry, such as the FRCA and CROA, so that you can comprehend the credit repair area before you begin sending out letters en masse.

DisputeBee Alternatives

I know what you’re thinking: why would I need an alternative when I already know how beneficial DisputeBee is? If you’re searching for a DisputeBee alternative, I recommend checking out Credit Repair Cloud to start building your dream credit repair business.

Credit Repair Cloud, on the other hand, has done an exceptional job for various business owners in terms of delivering successful results. DisputeBee is the ideal tool for you if you wish to utilize it for personal purposes. We give the Dispute Bee review a thumbs up as well!

Credit Repair Cloud is a market-leading and rapidly expanding organization that assists entrepreneurs in launching credit repair businesses. It provides credit restoration software, techniques, and tactics to help you start your own business.

You will receive free training when you join Credit Repair Cloud. You will learn how to bring in new clients, enhance credit ratings, and make revenue in this program.

Get Credit Repair Cloud here

Conclusion

DisputeBee is a must-have credit repair software that works flawlessly for contesting bad items. The software includes training and educational videos to make it simple to use. If you want to start a credit repair business, you should be aware of the issues that come with it. You don’t have time to compose hundreds of dispute letters by hand; let DisputeBee handle it for you.

For your business, DisputeBee is a one-stop credit restoration software. From beginning to end, it is totally automated. The pre-formatted letter templates and bulk generators are my favorite features of DisputeBee because they make the process so much easier. Furthermore, there is an option for E-Contract integration, which sets it apart from the competition.

If you’re looking for reasonably priced and high-quality software for your credit repair business and are unsure, we hope this DisputeBee review has clarified things for you.

When starting a credit restoration business, DisputeBee is a good credit repair tool to use.